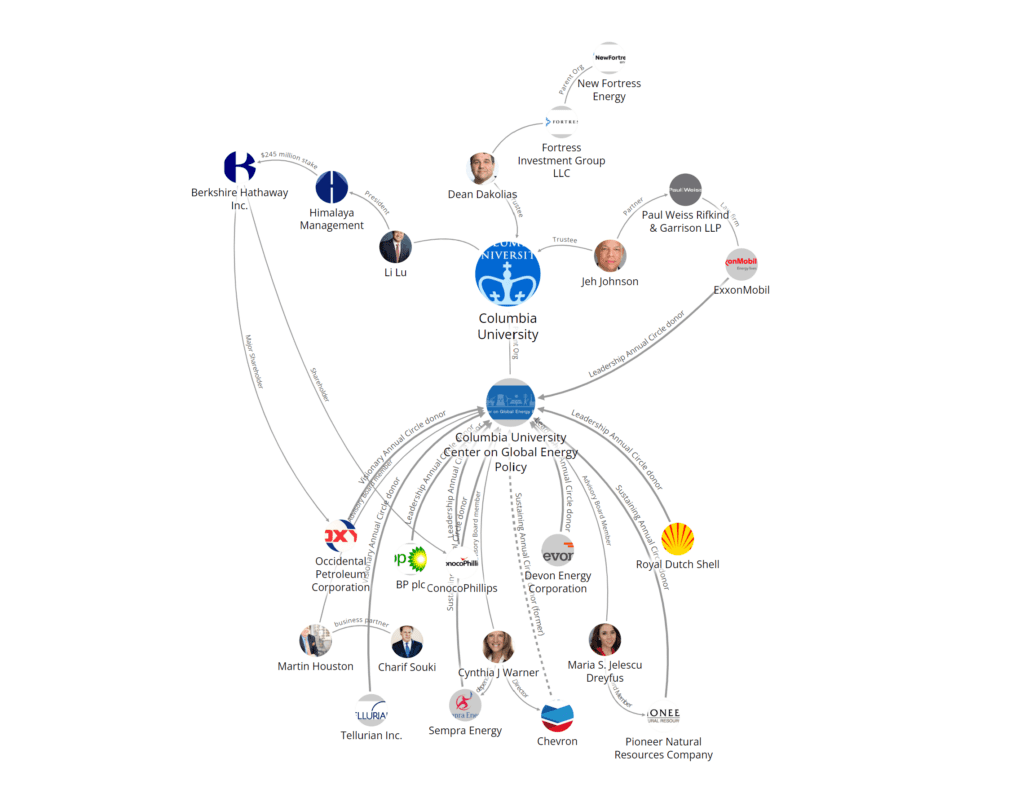

As the final authority for university business, members of the Columbia Board of Trustees make all legal and fiduciary decisions, although they delegate some specific powers and duties to others.

According to a March 2024 report published by the Public Accountability Initiative, 32% of board members (seven out of a total of 22 board members) have recent ties to fossil fuel companies.

Three members of the Columbia Board have direct ties to the fossil fuel industry.

Jeh Johnson

Johnson is a former Secretary of Homeland Security and is a partner at the law firm Paul, Weiss, Rifkind, Wharton & Garrison, LLP. In addition to Columbia, Johnson is on the Board of Lockheed Martin, U.S. Steel, and MetLife.

Paul, Weiss, Rifkind, Wharton & Garrison, LLP received an ‘F’ grade from Law Students for Climate Accountability for the firm’s work on lawsuits exacerbating climate change and on fossil fuel transactions. The firm worked on 33 cases exacerbating climate change and on fossil fuel transactions worth $7.6 million from 2017 through 2021.

Paul Weiss has represented ExxonMobil in a number of cases, including

successfully defending the oil and gas corporation from a suit brought by New York State, accusing ExxonMobil of misleading investors about climate change.

Johnson is also on the board of Lockheed Martin, the largest contractor to the United States Department of Defense. The U.S. military is the world’s largest institutional consumer of petroleum and the single largest institutional producer of greenhouse gases in the world, according to a paper from Brown University. Additionally, Lockheed’s profits depend on selling polluting, fossil-fueled jets.

Dean Dakolias

Dakolias is the Co-Chief Investment Officer of the Fortress Credit Funds. In addition to serving on the Board, Dakolias also serves on the Board of Visitors for the School of Engineering and Applied Science and the Athletic Leadership Committee.

Fortress Credit Funds is part of Fortress Investment Group, a large investment management firm. Fortress is a major oil and gas investor through financing and investing in fossil fuel companies as well as through its New Fortress Energy subsidiary, which builds and operates gas infrastructure, including gas-fueled power plants, infrastructure, and LNG terminals.

Li Lu

Lu is the Founder and Chairman of Himalaya Capital Management, an investment management company. Lu is a protege of Berkshire Hathaway chairman Warren Buffett. In addition to Columbia, Lu is on the board of the California Institute of Technology.

Lu has $245 million invested in Buffett’s firm Berkshire Hathaway. Berkshire Hathaway is a large oil and gas investor with a 25% stake in Occidental Petroleum and ownership of BNSF Railway, which transports fracked oil from Western shale plays.

Learn about Columbia Trustee Shoshana Shendelman here.

The Columbia Business School

Numerous other fossil fuel-tied individuals sit on the Columbia Business School’s Board of Trustees, including:

- Board Chair James Gorman is Chairman and CEO of Morgan Stanley, one of the world’s top fossil financers.

- Henry Kravis is the co-founder and co-executive Chairman of the private equity firm KKR, which has a significant fossil fuel portfolio and is the top stakeholder in the controversial Coast GasLink Pipeline. Kravis has made huge donations to Columbia and has a building at the business school named after him.

- Sheldon Stone is the principal and co-portfolio manager of Oaktree Capital Management, which has significant fossil fuel investments.

- Marie Ffolkes, a member of the Global Advisory Board of the Chazen Institute for Global Business at Columbia Business School, sits on the Valero Energy board of directors.

A visual representation

Learn more about Columbia’s Center for Global Energy Policy here.